BNPL as a Service

The turnkey BNPL platform for Banks, PSPs and international merchants

Built on card infrastructure

Fast time to market

Full brand ownership

Merchant Portal

EN

Antoni Nowak

Orders

Type to filter

01.05.2022

-

02.05.2023

All companies

All companies

All shops

Select action

ID

Reference

Shop

Shopper

Amount

Product

Status

Created at

1JF0A4HGKL8ZBQWX

420

Sportsworld

Anna Nowak

€99.00

Slice

Pending

2023/02/01

11:02:34

2JF0A4HGKL8ZBQWX

419

Sportsworld

John Smith

€200.00

Slice

Pending

2022/12/03

06:45:12

3JF0A4HGKL8ZBQWX

418

Sportsworld

Kate Johnson

€1240.00

Pay later

Completed

2022/12/03

10:23:10

4JF0A4HGKL8ZBQWX

417

Sportsworld

Peter Williams

€999.00

Pay later

Completed

2022/12/03

11:44:20

5JF0A4HGKL8ZBQWX

416

Sportsworld

Emily Brown

€75.00

Slice

Completed

2022/12/03

15:02:34

2023/02/01

Amount

Payments

Next payment

Reference 420

Sportsworld

€99.00

€33.33

2023/03/01

Partially paid

Solutions

Paywerk lets you get to market fast and start offering BNPL products without spending resources on product development – we take care of the complexity, so you can focus on your customers.

Bank

Bring a self-branded BNPL product to the market within 8 weeks and at 10x lower cost of building the solution in-house.

Payment Service Provider

Capture more revenue and and improve end-user experience by introducing your own BNPL payment solution to your merchants.

International Merchant

Improve and unify shoppers’ user experience and reduce transaction costs by introducing a standardised cross-border payment solution to your e-commerce checkout.

How the modular BNPL platform works

We help bring your BNPL to market – you choose the features and services you need.

White label end user layer

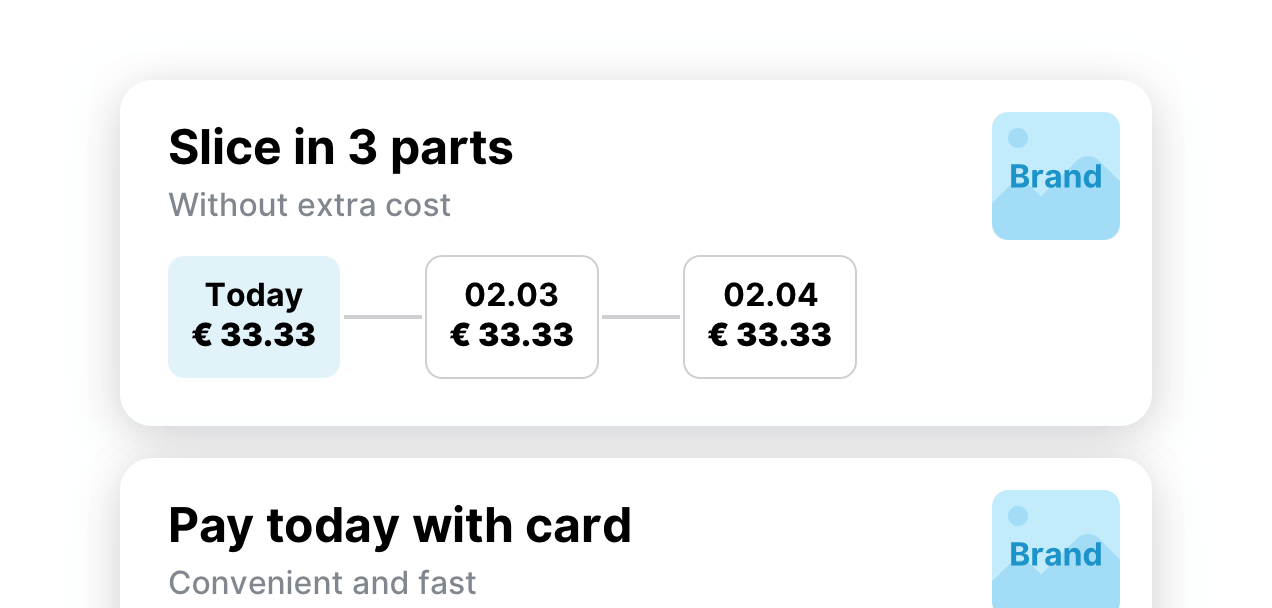

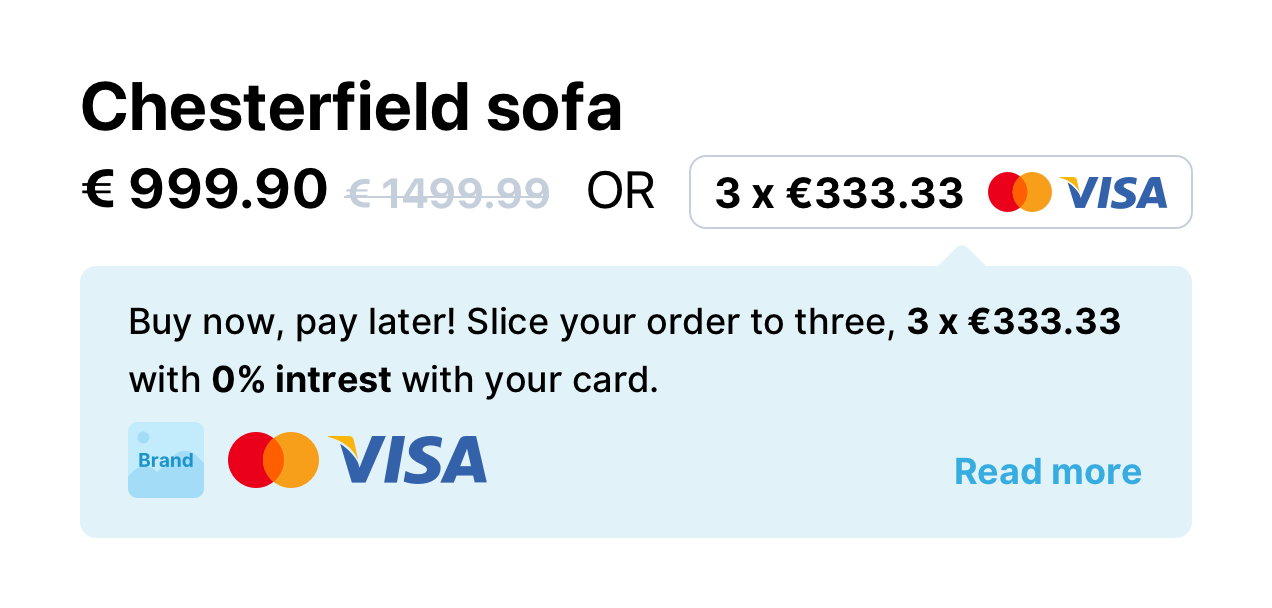

Checkout products

Offer Pay Now, Invoice and Slice products with your brand on the label.

Marketing toolbox

Promoting payment solutions is key in e-commerce – merchants can easily integrate informative promotional widgets to their product pages and elsewhere on their site.

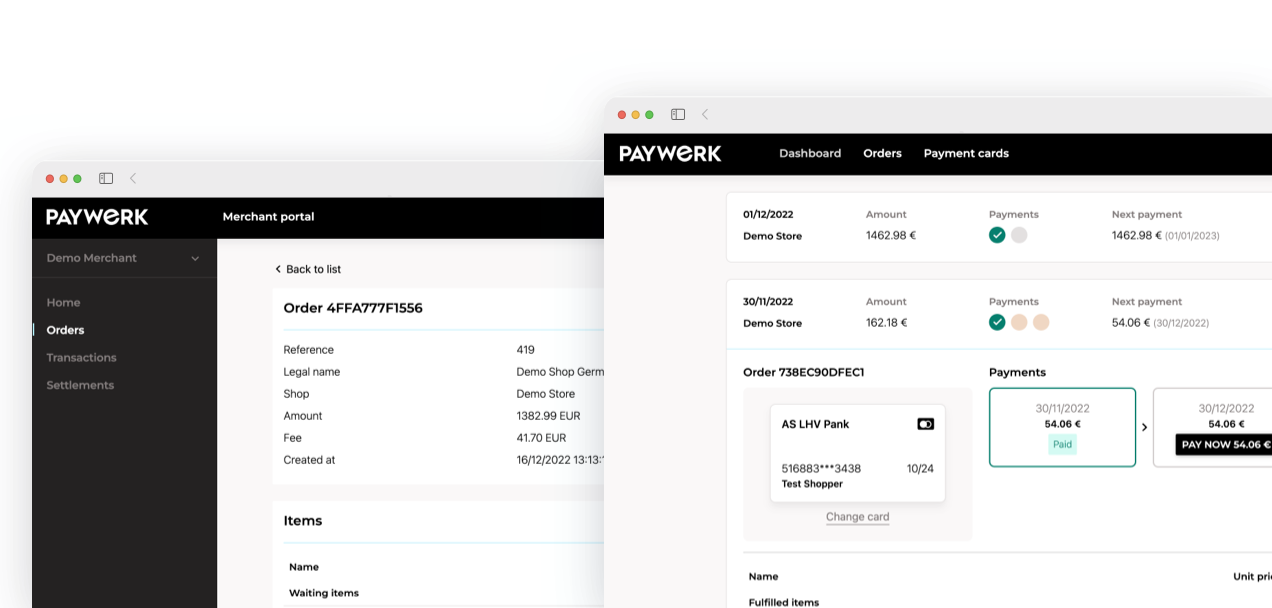

Merchant and shopper portals

Merchants and shoppers can manage orders, view transactions and see reports in dedicated portals.

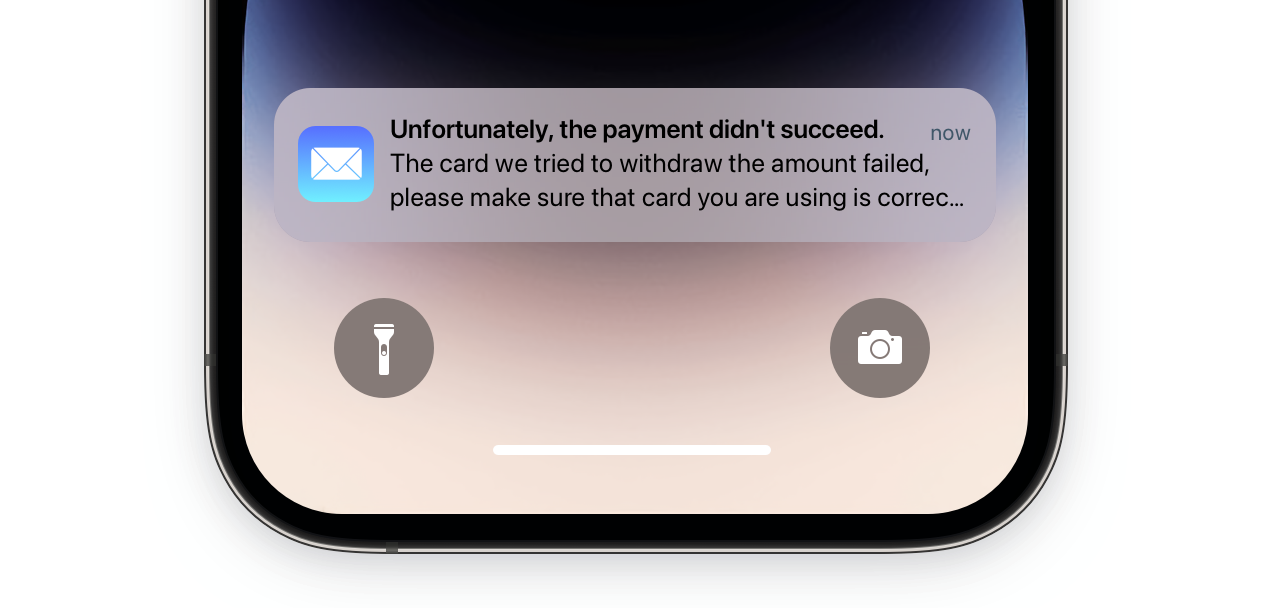

Repayments reminder system

Remind shoppers about future transactions and missed payments.

White label end user layer

Integrations and plugins

Merchants can integrate the BNPL products via native plugins or directly via API, making their onboarding process a breeze.

Supporting Infrastructure layer

Credit decision engine

Paywerk can take care of credit decisions – you define the risk appetite, we take care of the rest.

Merchant pricing

Full control over pricing the payment methods.

Dedicated data warehouse

BNPL database gives you access to all product usage data, enabling you to make better business decisions.

Real-time access API

Full access and control over product features via the dedicated API.

How we set your project up

With Paywerk’s turnkey platform, you can introduce your BNPL product to the market in just up to 8 weeks

1

Solution design

We map out your white-label BNPL product solution during a collaborative workshop.

2

Onboarding

Configuring the product and branding solution, and developing the commercial agreement.

3

Launch

Final product testing and launching it to customers.

4

Support

Ongoing product support from Paywerk.